What Does Future Look Like for NFTs and Wine?

Non-fungible tokens (NFTs) mean different things to different people, and that’s part of their inherent buzz-worthiness. Essentially, NFTs are designed to be fraud-proof digital certificates of ownership and authenticity, held on the block chain.

But in practice, they can be attached to anything from the esoteric and abstract (digital perfume, or a symphony of farts, for example) to the serious and tangible (a Beeple artwork sold for $69.3 million, or a house that sold for $653,000).

The first NFT emerged in 2014, but the market wasn’t mainstreamed until 2020-21, and about 70% of Americans still don’t really understand what an NFT is. But the $22 billion NFT market has drawn increased interest from the world of wine, largely for two reasons: 1) it appeals to the type of consumer (younger, more affluent than average) it is often accused of failing to adequately engage and 2) it ensures proof of authenticity.

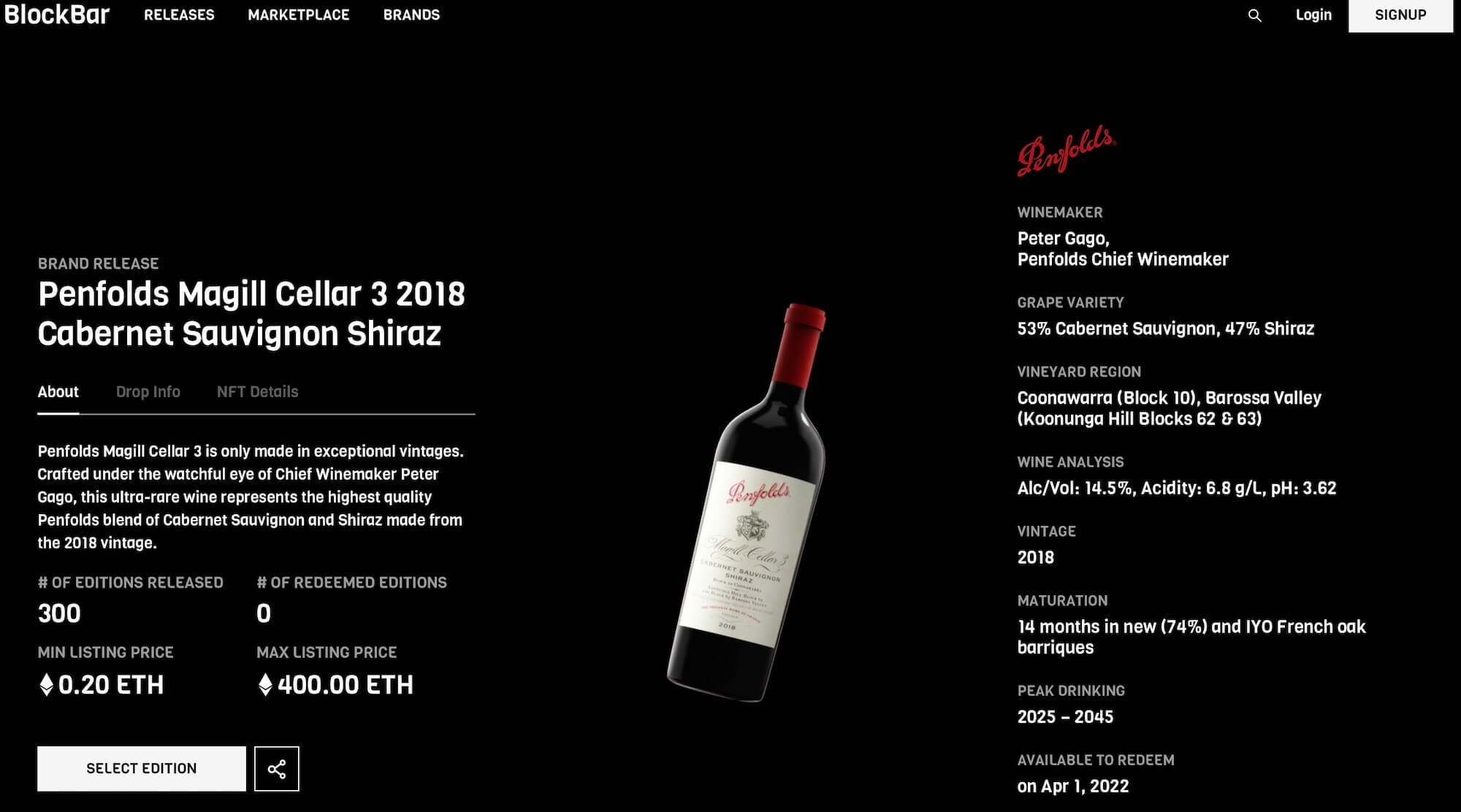

In the past year or so, several bold-faced wineries have debuted NFTs, from Robert Mondavi, to Yao Family Wines, to Chateau Angelus and Penfolds. (Read our piece on Mondavi’s drop here). There’s even the World’s First NFT Wine Club, although our attempt to reach out and get more information not shared in the low-on-details high-on-hype press release was met with an ultimately nonresponsive bot.

So we reached out to flesh-and-blood wine experts for their take on whether NFTs and wine are the future of wine, or just a flash in the pan.

Targeting New Demographic + Buzz

“NFTs appeal to a younger generation in the same way any new technology does,” says attorney Asher Rubinstein, a partner at Manhattan’s Gallet Dreyer & Berkey and a member of the Wine, Beer and Spirits Law Committee at the New York State Bar Association. “NFTs are also huge buzz generators. When you have established wineries like Mondavi and Angelus doing NFTs, even if they aren’t instant sell-outs, it will bring attention to these brands from a younger generation that may not even have them on their radar.”

Robert Mondavi Winery x Bernardaud - Bottle Trio photo credit Robert Mondavi Winery

Charlotte Selles, general manager of Robert Mondavi, wouldn’t disagree with Rubinstein. “Following the release of the Robert Mondavi Winery x Bernardaud collection—a limited series of exquisitely designed Limoges porcelain wine bottles holding custom wine blends that we offered exclusively through generative art NFTs—we’re noticing that our newly ‘minted’ customers are not new to wine, rather, that they are new to wine collecting,” Selles says. “The release certainly also led to an increase in Robert Mondavi Winery’s social media audiences, traffic to our website, interest from on or off-premise accounts, etc. Beyond this initial buzz, however, we anticipate that our biggest success will result from our long-term approach to customer relationship management (CRM), as well as the many innovations this collection ignited with respect to wine authenticity, traceability, and ownership.”

Fraud Prevention + the Future

Fraud in the wine industry, as Selles alluded to, is a scourge—an estimated $3 billion one at that. Many see NFTs as the only way to combat fraud, while simultaneously allowing both producers and consumers to invest in future profits, today. “NFTs lock authenticity in on the blockchain,” says Rubenstein. “That means buyers can trace ownership of a bottle from the beginning, something that has never been possible before. But there are so many other things that can be written into the code too. If Napa’s Screaming Eagle, say, writes that they get residuals in perpetuity every time that NFT-linked bottle is sold, they will get just that.” So that $500,000 bottle of 1992 that sold in 2000? Screaming Eagle didn’t see a penny of it but could potentially if it’s in the code.

Rubinstein also sees an opportunity a la Bordeaux futures for the NFT. “A barrel of wine contains dozens of cases,” Rubinstein notes. “You could create NFTs that allow for fractional ownership that you could then sell later. Anything can be written into the code.”

But not everyone is convinced that NFTs will resolve the vexing issues of fraud. “From my view, I still don’t think cryptocurrency, which is linked to NFTs, will make it, but it’s gotten a lot further than I thought it would,” says Rob McMillan, executive vice president and founder of Silicon Valley Bank’s wine division. “I still just can’t see governments allowing a secondary uncontrolled financial system. China has already clamped down on it. It’s too convenient of a place to launder criminal transactions.” And if crypto gets regulated, McMillan believes it will lose its inherent appeal. “I’d say blockchain technology does have a potential place in protecting the provenance of collectible things like art and wine,” he says.

But while NFTs are blockchain-based, the blockchain exists beyond the realm of NFTs. Only time will tell where the market settles, but clearly, a more digital future is upon us for the world of wine making, selling, investing and collecting.